The story is however different for Savings and Loan companies and Microfinance companies, which are largely considered unsafe.

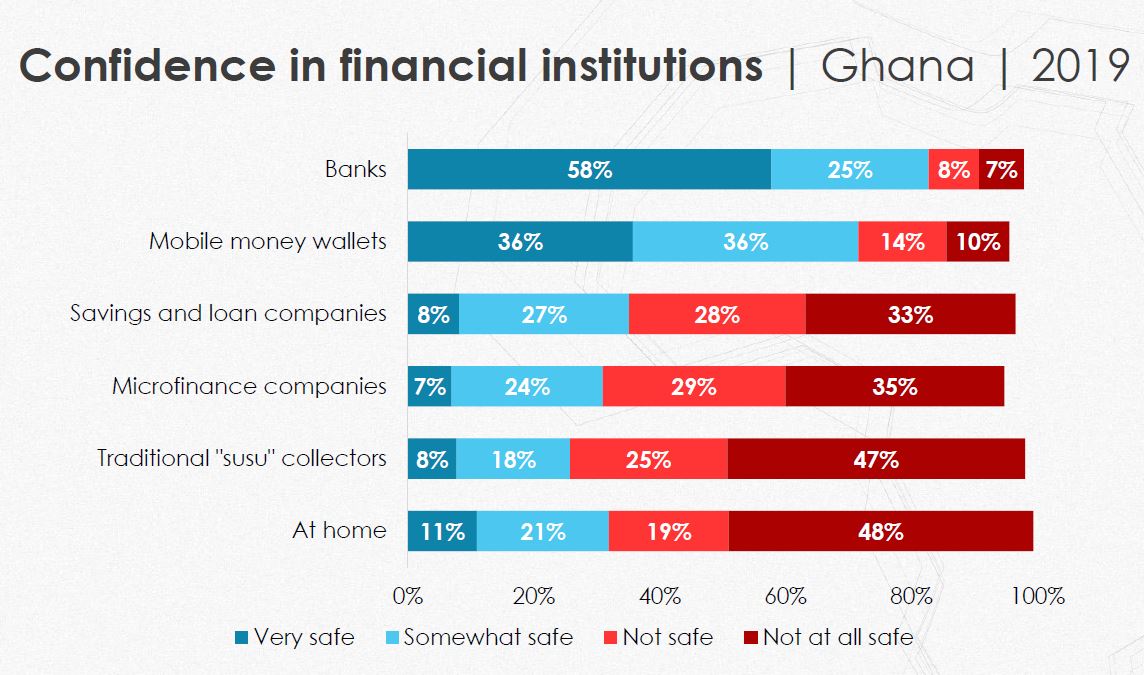

According to a recent AfroBarometer survey, 58 percent of Ghanaians feel banks are a very safe place to keep their savings.

A further 25 percent felt banks were somewhat safe with 8 percent and 7 percent respectively saying banks were not safe and not safe at all.

On the Savings and loans front, 61 percent of Ghanaians feel they are either not safe or not safe at all.

Microfinance companies were given a vote of no confidence with 64 percent saying they are either not safe or not safe at all.

ALSO READ : McDonald’s boss fired for dating employee

The only other option with some confidence from the public is saving in mobile money wallets.

Seventy-two percent of Ghanaians generally felt their mobile money wallets were safe.

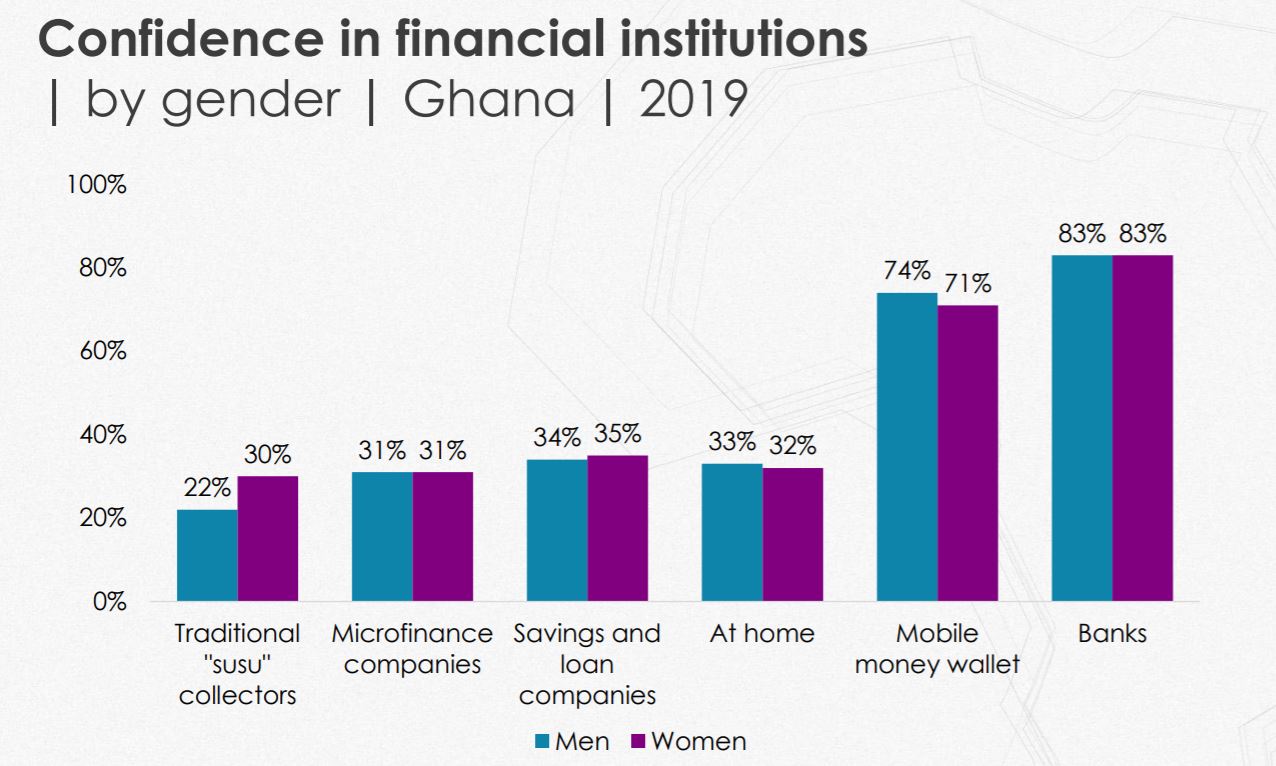

These sentiments remained consistent over various demographics ranging from age, education level, gender and residence among others.

The sample size of the survey in Ghana was 2,400 adult citizens.

Despite the confidence in the banks, only half of the respondents said they owned bank accounts.

As part of the Bank of Ghana’s cleanup of the financial space, it revoked the licences of nine universal banks, 347 microfinance companies of which 155 had already ceased operations, 39 microcredit companies or money lenders, 15 savings and loans companies, eight finance house companies, and two non-bank financial institutions.

The total estimated cost of the state’s fiscal intervention, excluding interest payments, from 2017 to 2019 is estimated at GHS16.4 billion.